Property ownership is one of the most serious commitments you can undertake. In Singapore, the typical mortgage lasts between 25 to 30 years, or most of your adult life.

Due to the long loan tenure, and the severity of losing your home, it’s important to make sure you meet certain milestones before buying.

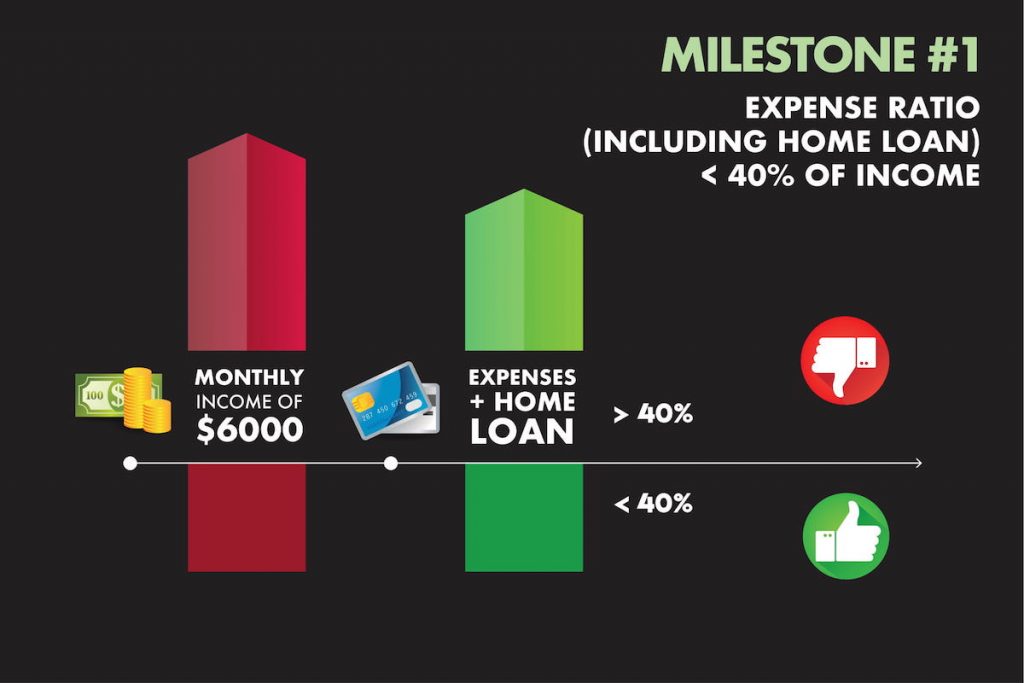

Milestone 1: Your debts are low enough that, even with a mortgage, your expense ratio does not exceed 40 per cent

Your expense ratio is the proportion of your monthly debt, to your monthly income.

For example, if you earn $6,000 per month, and your monthly debts are $3,000, you have an expense ratio of 50 per cent (an imprudent amount).

You need to keep your expense ratio low for two reasons…

First, it will affect your ability to get a home loan. Under government regulations, bank home loans are capped at 60 per cent of your monthly income; this is called the Total Debt Servicing Ratio (TDSR).

Your home loan, when added to your total debts (credit cards, personal loans, etc.) cannot exceed 60 per cent of your monthly income. Otherwise, you’ll be forced to make a bigger down payment, or stretch your loan tenure.

For HDB loans, you will face the Mortgage Servicing Ratio (MSR). This restricts your home loan (excluding other loans) to just 30 per cent of your monthly income.

Second, it’s a matter of financial prudence. If you are spending more than 40 per cent of your income to service debt (remember, this is for 25 to 30 years), there’s a higher chance that you do not also have enough to save and invest.

As such, you should focus on paying down your debts, in the 12 months prior to getting a home loan.

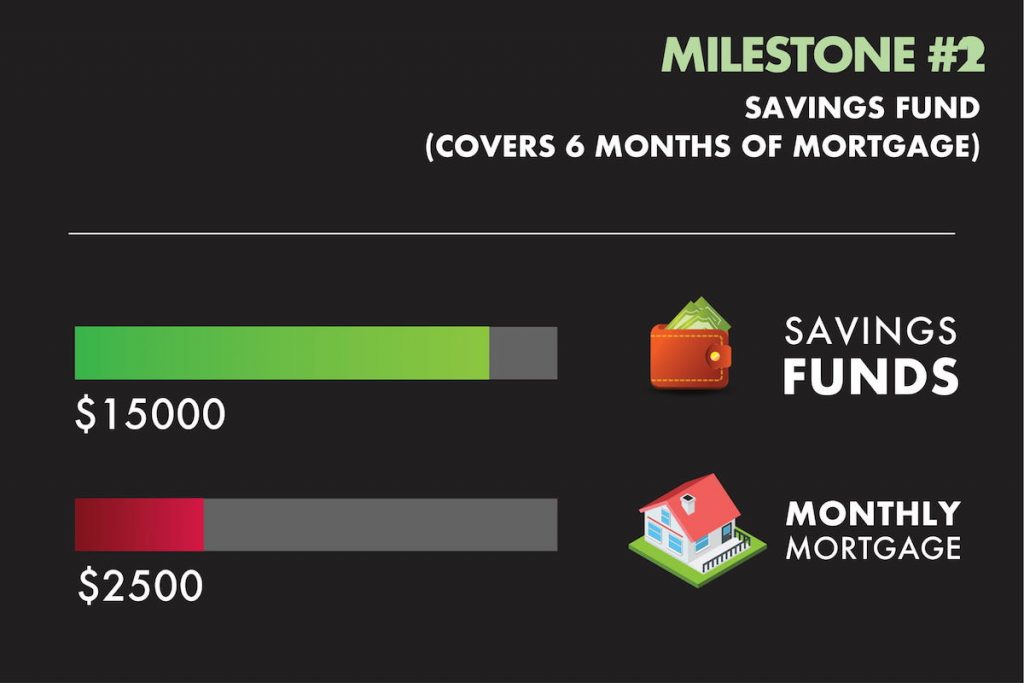

Milestone 2: You have a savings fund that covers six months of the mortgage

If you cannot service your home loan, the bank (or HDB) has a right to foreclose on the property.

As such, home ownership is not appropriate if you’re still living from paycheque to paycheque.

You should ensure that – even if you lose your income – you will be able to keep the mortgage paid for a half a year. This is extra time to find a new job or – at the worst – to sell the house at a good price and downgrade.

In addition to this, you should ensure that you have a good mortgage insurance plan. With Mortgage Reducing Term Assurance (MRTA), for example, your outstanding home loan will be paid off in the event of your death, or permanent disability.

HDB flat owners must at least have the Home Protection Scheme (HPS), which is a mandatory form of mortgage insurance.

However, flat owners can also choose to replace HPS with a private mortgage insurance policy (private mortgage insurance can sometimes be cheaper, and save you money every month).

For private property owners, mortgage insurance is not automatic.

Do be sure to insure your home loan; you can contact us to learn more.

Milestone 3: You can service the down payment without emptying out your savings

For bank loans, the lowest possible down payment on a property is 25 per cent of the value. At least five per cent of your property must be paid in cash, and 20 per cent can be paid with your CPF.

For HDB loans, the lowest possible down payment is 10 per cent. This can be paid through your CPF.

You should not purchase the property until you can comfortably cover the down payment, without emptying out all your savings.

Milestone 4: You are prepared to do your homework on the loan

Mortgage rates can get complicated.

They are predominantly based on either the Singapore Interbank Offered Rate (SIBOR) or a Fixed Deposit Home Rate (FHR).

At any point in time, two or three out of several hundred available loans will be the cheapest.

(There’s no advantage to a more expensive loan).

You should learn to use methods like refinancing, or work through mortgage brokers, to minimise your home loan costs.

Do be prepared to do some research; this process will take a little more time, compared to simpler loans like credit cards or personal loans.

Milestone 5: You have a good credit score and history

Your credit score is determined mainly by how reliably you repay loans, and by the amount you have borrowed.

The lower your credit score, the less you can borrow for your house – and hence the higher your down payment.

You can check your credit score with the Credit Bureau of Singapore (CBS), for a fee of $6.42 (banks and other financial institutions will check the credit score also, before giving you a loan).

Note that, if you have never used credit before, this is also not a positive.

The bank will not know how much to trust you, as you have no credit history.

One simple trick is to take a small loan (say $1,000), and repay it consistently to get an AA credit score.

Milestone 6: You have clear plans regarding the property

Make up your mind if your property is a stepping stone (e.g. you will upgrade from your flat to a condo one day), an investment (you will rent it out for cash), or simply a home for life.

This will affect decisions such as when to sell, and how much to sell for.

It will also help you to work out a justifiable cost when renovating (if you are going to sell and upgrade in five years, when your Minimum Occupancy Period is over, then don’t spend on costly renovations like walk-in wardrobes).

More importantly, if you are buying the house with a spouse or other family member, it will avoid disputes later.

All the co-owners should be on the same page, on the plans for the house.

Milestone 7: You have done your homework on the area and have all the key info

Before buying, you should check the median prices and rental rates in the area.

This can be done through a qualified property agent, or through various property portal sites.

Don’t just check the current prices, be sure to look at the price movements over 10 to 15 years.

This will give you a sense of how well properties in the area have been doing, and whether you are paying a fair price.

Finally, check the URA master plan for the area.

A neighbourhood may seem quiet and peaceful now – but it may not be when a row of clubs moves in down the street! (Check if the area is being rezoned for industrial or entertainment use).

Above all, protect your property with the right insurance and savings

Most problems with property come from unexpected costs – factors like maintenance, property tax, etc. are all predictable, and easy to plan for.

Instead, focus on guarding against situations that you cannot easily see coming, such as sudden retrenchment or illness.

This means a good combination of mortgage insurance, health and life insurance, and regular savings.